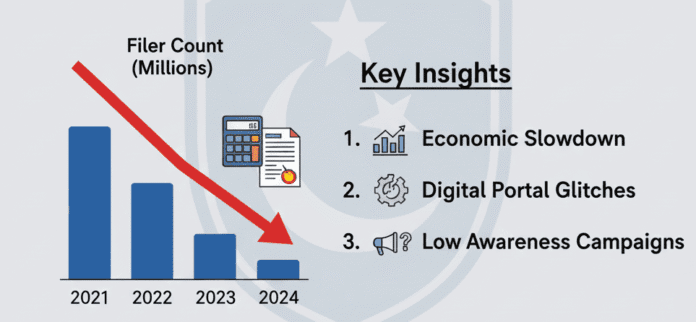

The FBR tax return filing decrease has become a serious concern for Pakistan’s financial regulators and economists. Recent figures show a clear drop in the number of taxpayers submitting online returns through the Federal Board of Revenue (FBR) portal this year. Although digital tools have made filing easier, participation has declined for the second time in a row.

A Noticeable Drop in Numbers

According to preliminary data, the total number of returns filed so far has fallen by nearly 15 percent compared to the previous year. Officials attribute the slowdown to several factors, including economic pressure, limited awareness, and technical challenges on the FBR portal.

Earlier campaigns encouraged citizens to file on time, yet many users postponed submission until the final days. As the deadline approached, heavy web traffic caused slower response times, discouraging last-minute filers.

Why the Decrease Matters

Experts warn that the FBR tax return filing decrease could weaken Pakistan’s tax base. A smaller number of active taxpayers limits the government’s ability to fund public projects and manage inflation.

Tax advisor Ahmed Khan explained,

“People hesitate when systems feel unreliable. Therefore, improving user experience is just as important as enforcing penalties.”

The digital economy also plays a role. Freelancers and small online businesses often earn through global platforms but remain uncertain about how to declare digital income. As a result, many skip filing altogether.

Economic and Technical Challenges

Rising inflation and fuel prices have placed households under financial strain. Consequently, some self-employed citizens prefer to delay filing or underestimate their income.

Moreover, while the FBR portal allows online registration and payment, users continue to report occasional verification errors. These issues discourage new filers, especially those unfamiliar with digital procedures.

Because of these obstacles, economists urge the FBR to launch a simpler, mobile-friendly interface that guides users step-by-step.

Government’s Response

The Federal Board of Revenue acknowledged the decline and announced new measures to encourage participation. An upcoming initiative called “Tax Simplify 2025” will focus on awareness sessions, improved servers, and clearer guidance videos.

In a recent statement, an FBR official said,

“We recognize the gap and are working to build public trust through education and technical stability. Our goal is to make the digital filing process smooth and reliable.”

Additionally, the FBR plans to integrate with NADRA and commercial banks to verify taxpayer information automatically, reducing errors and duplicate entries.

Public Perception

On social media, the discussion around the FBR tax return filing decrease quickly gained attention. Some citizens praised the transparency of the new system, while others complained about portal slowdowns and repeated verification requests.

Many users posted screenshots of submission delays, urging the authorities to extend the filing deadline. Despite the criticism, several praised the FBR’s move toward modernization and called for ongoing improvement rather than complete system changes.

Expert Opinions

Financial analyst Dr. Sara Ali noted that the FBR must focus on education rather than punishment. She said,

“If taxpayers understand why filing helps them personally, participation will rise naturally.”

She also recommended a small incentive—such as fee reductions or discounts for early filers—to boost motivation.

Steps Toward Improvement

To rebuild confidence, experts suggest:

Simpler digital forms that take less than 10 minutes to complete.

24-hour technical helplines during peak filing days.

Awareness campaigns through schools, colleges, and digital platforms.

Automatic reminders sent through SMS and email before deadlines.

Implementing these steps could turn the FBR tax return filing decrease into an opportunity for reform and modernization.

External Sources:

Conclusion

In summary, the FBR tax return filing decrease reflects both technical and economic challenges in Pakistan’s digital transition. While the decline is worrying, it also highlights the need for stronger communication and improved systems.

If the FBR follows through on its reform plans, more citizens may regain confidence in online filing. Ultimately, consistent education, transparency, and smoother technology will strengthen Pakistan’s tax culture and digital governance.